“Working with Doug Downer from Franchise Ready changed the direction from our small restaurant into a national franchise company.“

Pete Haselhurst – Milky Lane – Founder and Managing Director

Systems and processes are the key for businesses to grow

I believe every business should be franchise ready. Not every business should or will become a franchise, but every business should be ready to franchise. This forces you to systemise and remove the dependency on you, the business owner, which enables a business to grow exponentially.

There’s proof that systemised businesses, with documented processes operate successfully regardless of whether the owner is active, sell for a much greater value. While business valuation is important (we will always have to sell at some point), it is just as crucial that the business owner is able to remove themselves from doing ‘everything’ in the business.

Business owners go into business for a range of reasons: to be their own boss, to perfect their craft, to create a legacy, to hopefully have more money than they would make as an employee, to provide for their family, and for the pride of creating their own business and destiny. But the one I hear most is, to have freedom and quality of life.

Complete our Franchise Readiness Scorecard and get a complimentary whiteboard strategy session!

If you speak to 99% of business owners, they will tell you that particularly in the early stages of a business’s growth, they were or are the hardest working and lowest paid employees in their business.

There are over 134 Million results on Google regarding the stages of business growth, with anywhere from four to seven stages identified.

A significant proportion of business owners will have similar experiences in their journey. I believe business is a rollercoaster, with lots of ups and downs, which can be scary at times but exhilarating at others.

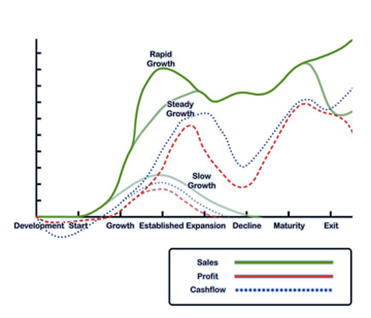

I have identified what I hold to be the eight stages of business growth and the associated ups and downs that go with each.

Understand the different stages of business growth and what each stage will do with regards to profitability and cash flow

1. Development

The Development phase is where the founder of the business has identified an idea, as either a concept or product, that they would like to take to market. At this stage the founder needs to complete the requisite research to determine if there is in fact a need for the proposed business. The creation of a well-structured business plan is essential. There is no positive cash flow and no profitability, only expenditure.

2. Start-Up

The business is now a reality. You’ve registered the business entity, your products and services are in operation, and you have customers paying for your products and services.

In this phase, business owners take on any customers and do whatever it takes to survive. The owners are working hard, primarily as technicians, and the business works because the owner is working so hard. The business succeeds and grows because of the efforts of the business owner.

At this stage, the owner is fulfilling most functions in the business, with particular attention on marketing to grow the business, and finance to manage the cashflow.

As entrepreneurs, we are typically optimistic and think things will happen quicker than they actually will. The start-up phase can be frustrating. It can take a long time for businesses to move through the next stages of their growth. There are sales but not as many controls in place, so cash flow is good, but profitability is low. The owner is probably not taking a nominal salary, if any at all.

3. Growth

There are three types of growth that you may experience: slow growth, steady growth, or rapid growth.

Slow growth can be challenging, especially after all the hard work that you’ve put into the business. Globally, 50% of all start-up businesses close their doors within the first five years, as they don’t grow at the rate they need to sustain their operating costs.

Achieving steady growth enables the owner to fine tune operations and perfect their business model.

Rapid growth sounds great, but can be just as challenging as slow growth, as it requires the business owner to be involved with more activity. In most cases, the owner has not been able to add the right resources to the business and is often still completing most tasks themselves. In this case, they are unable to bring in the right people to delegate responsibility to. Periods of rapid growth may see significantly greater cash flow but lower profitability because the systems and processes are not in place to manage the extra demands of a fast-growing business.

4. Established

The Established phase sees stability within the business, with consistent sales and strong customer loyalty. The business owner has time to focus on strategy and developing the next stage in the development of the business.

Sales are still growing but not as rapidly, and profitability is strong. At this stage, the business owner can start to realise their desire for freedom and quality of life.

It is important that the owner does not take their foot off the accelerator too much. This can happen as the business operations becomes more routine.

The business needs to continue to invest into human resources and bring in additional expertise. It’s time to ensure that policies and procedures that got the business to this stage are documented to enable scale and expansion.

It is in the established phase that the business owner needs to determine what is next. Should they expand? If so, how should they do it?

This is normally when a business owner should consider franchising.

5. Expansion

This stage is characterised by growth either into new markets or distribution channels.

Moving into new markets includes opening in new locations, while distribution channels may include either, or both, vertical and horizontal integration. Vertical integration includes taking control of the supply chain and generating additional income, while maintaining quality and control over key products, supplies, and ingredients. Horizontal integration includes the acquisition of similar-type companies that can be bolted onto the existing business.

In the expansion stage, business owners will consider a range of vehicles to achieve continued growth, and the concept of franchising can be used to expand.

It is important to know that expanding into any new product will see an increase in sales and cash flow, but will have a significant impact on profitability, as investment is made in areas unfamiliar to the business owner. In most cases, this will take the business back into the start-up stage.

6. Decline

Business is increasingly more competitive, and if owners don’t reinvigorate their business and brands, or if they take their eye of their core business and get too distracted by growth for growth’s sake, their core business has the potential to go into decline.

Every business must reinvent themselves and ensure that their leadership is keeping in touch with the changing marketplace. One only has to look at the carnage in the Australian and international retail landscape to see the huge decline in business performance.

Going into decline is not necessarily the death nail for a business. Most will experience a decline in sales, market share, and profitability over time. It is how they react to the decline that determines the success of the business and its ability to progress to the maturity stage of growth. Just look at McDonald’s and how they had to reinvent themselves in the past 15 years with the advent of McCafé, salads, healthy options, and the introduction of a totally different service style. This includes kiosk operations and a huge increase in the number of products sold, entry into the gourmet market, dining room upgrades, and store remodels. It is a dramatically different business to the one I worked in for so long, but reinvention was required to address stiffer competition and declining sales and relevance.

7. Maturity

The growth and expansion stages bring about diversification, but this can at times create challenges as the business is not fully matured. The maturity stage sees business sales steadily growing while delivering consistent and strong profitability. It is the period where businesses will spend the greatest amount of time.

Diversification and developing new products and markets is critical, as competition will be more significant.

Think about your exit strategy now and start planning for it from the outset.

8. Exit

At some stage in the life of a business, the founder or owner will exit the business, and this can be done a number of ways. It is the opportunity for the owner to cash out on all the effort and years of hard work.

In some cases, business owners may elect to shut down their business, I find this happens when the business has not adequately developed its systems and reinvented itself.

The key to exiting a business is a realistic valuation. It may have been years of hard work to build the company but think about the real value in the current marketplace.

Each stage of the business growth cycle might not occur in chronological order. Some businesses will be ‘built to flip’, quickly going from start-up to exit. Others will choose to avoid expansion, and stay in the established staged, as it provides the life the owner desires. The reality is that no one lives for forever. But hopefully the business the owner/founder has created will live on beyond their generation, with realised value they can take from it.

Due to a lack of planning, most business owners are faced with the harsh reality that their business is not worth what they think it is, when it is time to exit their business.

96% of business owners agree that having an exit strategy is important

Only 12% of business owners have an exit strategy!

75% of business owners who sold their business had post-exit remorse

I believe getting franchise ready is for every business owner who is currently working hard in their business and wants to take it to the next level. Read here to learn how others have scaled to ensure that they have a better business and a better life. So, when it finally comes time to sell or exit your business, you can yield the benefits of all your hard work.

Complete our Franchise Readiness Scorecard and get a complimentary whiteboard strategy session!

If the idea of being a franchisor doesn’t appeal to you, I want you to think about the concept of franchising from two perspectives:

- An External Franchise

- An Internal Franchise

An external franchise is what you may currently be familiar with. It is businesses like the McDonald’s, Subway, Jim’s Group, Poolwerx, and 7-Eleven.

An internal franchise utilises the same principles of the traditional franchise model, but instead of franchisees, it requires the treatment of your employees as if they were the franchisees. This creates an ownership mindset, which is one of the benefits of franchising.

If anyone has ever asked you “Are you a franchise?” then you should think about it.

Being a franchisor is not for everyone but thinking and behaving like a franchisor is a must for every business.

Takeaways

- Systems and processes are the key for businesses to grow.

- Start thinking and acting like a franchisor even if you don’t intend to franchise.

- Understand the different stages of business growth and what each stage will do with regards to profitability and cash flow.

- Think about your exit strategy now and start planning for it from the outset.

- Think about who your likely buyer might be.

Complete our Franchise Readiness Scorecard and get a complimentary whiteboard strategy session!